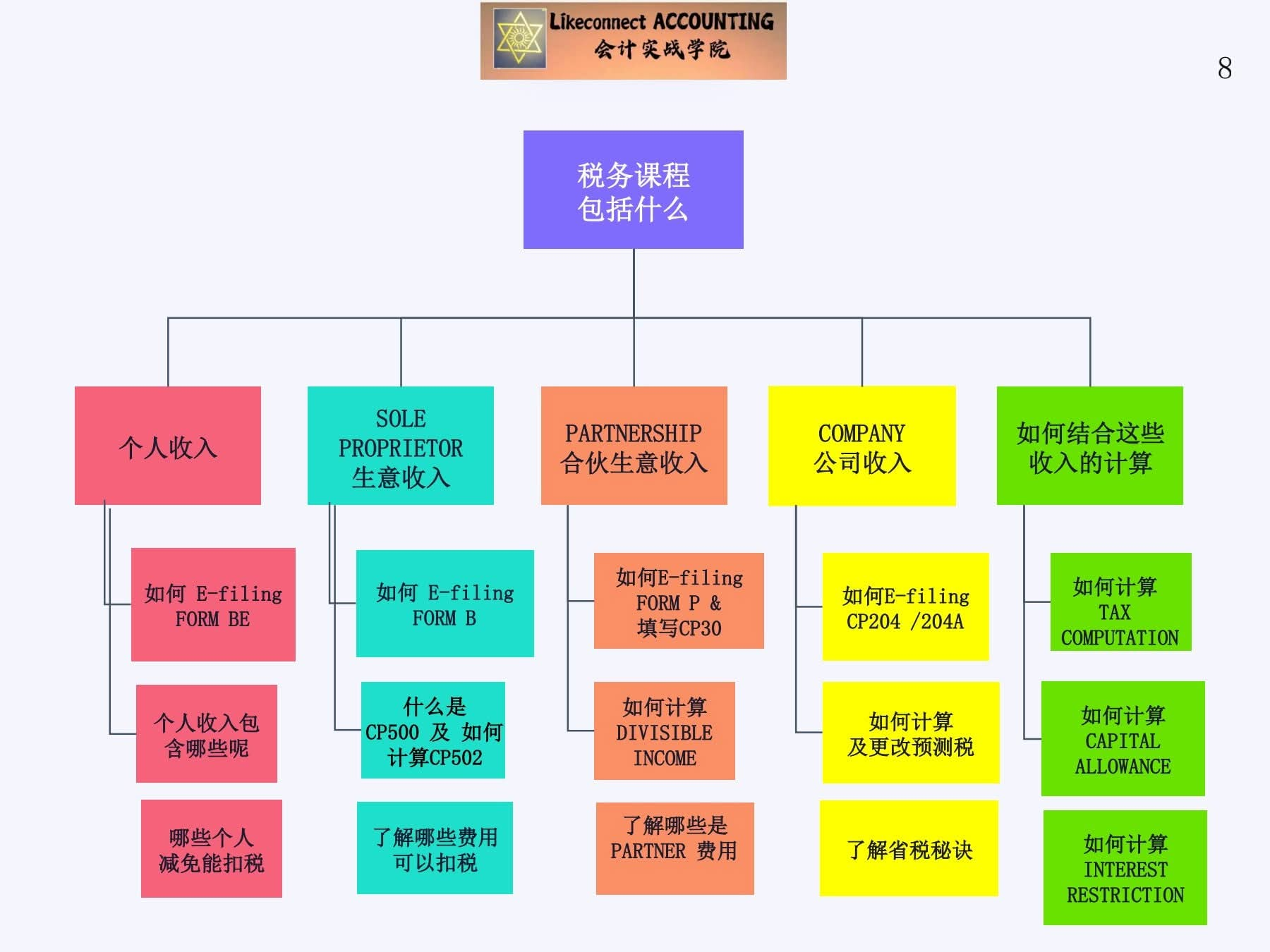

PRACTICAL TAXATION COURSE 税务计算课程(包括个人/生意税)

PRACTICAL TAXATION COURSE

RM1,699.00

AGENDA

CHAPTER 1 -PERSONAL INCOME TAX

Tax Residence Status In Malaysia

Identify Non Business Income

What is Rental Income & disallowed expenses

Personal tax Relief & Rebate

How to fill up Form BE

CHAPTER 2 -BUSINESS TAXATION

Business Deductible & Non Deductible Expenses

Withholding Tax -Facebook advertisement (Royalty Fee)

Withholding Tax -Rental pay to Foreigner

Withholding Tax 2% -Agent /Dealer/ Distributor

What is Capital Allowances and charges

Calculate Capital Allowance

CHAPTER 3.1 -SOLE PROPRIETORSHIP TAXATION

Sole Proprietor Tax Computation

Understanding the terminology of tax format

What is Unabsorbed losses

How to make payment for CP500

How to revise -CP502

How to fill up Form B

CHAPTER 3.2 -PARTNERSHIP TAXATION

Existence of a partnership

Provisional adjusted income / (loss)

Divisible income

Partners statutory income

Non business income from partnership

Partnership losses

How to fill up Form CP 30

How to E filing Form P

CHAPTER 4 -PRIVATE LIMITED COMPANY (SDN BHD) TAXATION

SDN BHD Tax Computation

Calculate Interest Restriction / Deemed Interest

What is CP204 & how to submit

Method of Estimation to revise CP204A & Submission

Tax Saving Tips for SME

Tax Saving in buying Motor Vehicle